As consumers get more acquainted with shopping and banking digitally, it seems logical that more people would be inclined to pay their bills online.

A consumer billing and payment trends and behaviors survey by ACI Worldwide shows that nearly 70 percent of respondents prefer digital payment options such as website and mobile app channels to pay one-time bills. The 2020 ACI Speedpay Pulse study polled more than 3,000 adult consumers in the U.S.

The results show that consumer preference is clearly digital. That means in order to meet the growing demand for digital payment processes, organizations must increase their digital and mobile payment offerings to address these demands or risk losing customer loyalty.

Billers have an opportunity to better align with consumers, the report suggests. For instance, over the last year, 57 percent of billpayers made a payment in person, while 39 percent made a payment through the postal service. But only 11 percent and 14 percent prefer these options.

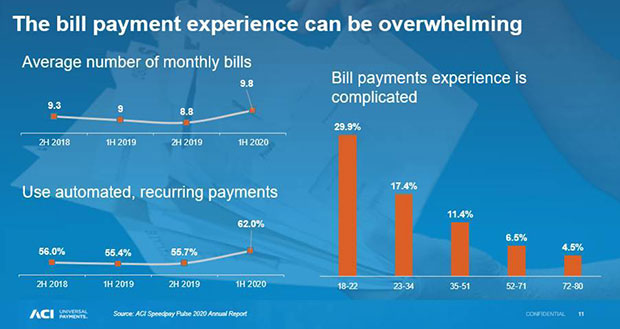

The results of the survey taken in March and April, and released on July 21, are significant to the continued health of the e-commerce ecosystem. U.S. consumers are now paying an average of 10 bills a month. During the pandemic, more bills have meant greater digital adoption.

Over the past year, one in four consumers has increased his/her usage of biller websites to pay bills. In that same time period, the percentage of mobile wallet usage has doubled, from 3.5 to seven percent.

The bottom line, the survey found, is that consumers want real-time digital payment options. But the type varies by age.

Older consumers (ages 52-80) are significantly more likely to prefer checking account deduction (ACH) or credit cards. Younger consumers (ages 18-34) are significantly more likely to prefer debit card payments.

One prominent downside exists with digital bill payment, however. The ACI survey also showed that consumers find the billing process overwhelming at times. That is the case particularly for younger demographics, according to Sanjay Gupta, executive vice president of ACI Digital Payments.

“They are still getting accustomed to myriad of bills and services for which they need to manage and pay,” he told the E-Commerce Times.

Pandemic Driven Changes

The restrictions imposed as a result of the pandemic led consumers to embrace the virtual and digital space even more than usual. According to the survey’s findings, this is especially true when it comes to billing and payments.

Fewer consumers are interested in traditional payment and statement methods. One in five consumers has decreased mailing payments through the postal service or paying at the biller’s location.

When it comes to billing statements, more consumers prefer digital billing statements (48.2 percent) to paper billing statements (25 percent) or a combination of digital and paper statements (26.8 percent). Consumers want real-time or near-real-time options.

“Digital transformation has been on the rise across so many industries, and the pandemic is only pushing consumer demand further,” said Gupta. “Consumer preference is clearly digital, whether it’s related to payment methods, channels or billing statements, and billers need to address these demands or risk losing customer loyalty.”

Organizations have to react in two ways. One is to increase their digital and mobile payment offerings. They must also implement ongoing educational initiatives to help their customers better understand their options, he added.

COVID-19 has forced companies of every industry to rethink their operations and change the way they do business. The surge in bill pay is no exception, according to Osiris Parikh, sales marketing manager at Lilius.

“It would make sense that consumers would want the convenience of making payments online, without the hassle and new risks of in-person banking,” he told the E-Commerce Times.

Balancing Act

Payment companies are implementing aggressive tactics to retain and acquire clients, according to Andres Ricaurte, senior vice president and global head of payments at Mphasis.

Convenience is a key selling point. Products such as Afterpay and Klarna reap the benefits of easy-to-use features like buy now / pay later. Offering smart advisories on what consumers should or should not buy attracts consumers as well.

Service to customers is another selling point for payment companies. For instance, at Amex, safeguarding the brand has meant doubling down on service and “taking care of customers, some of whom are going through stressful situations,” he told the E-Commerce Times.

Offering rewards and incentives is another key point to attract consumers. Every major payment player is upping the ante on rewards. Chase and Amex are both expanding their rewards coverage in services that are in the client’s path of relevance, such as online streaming and Instacart. Discover, in fact, permanently changed its travel rewards construct, Ricaurte explained.

“None of this is happening for free, and all banks and payment companies are in a balancing act between protecting the brand, retaining and growing customers, adhering to regulation, and maintaining return to shareholders,” he said.

Digital Distinctions

Differences exist that separate consumers using the “built-in” bill pay features of their online banking and credit card apps and adopting a dedicated payment service. Those differences can be significant, noted Andrew Barratt, managing principal at Coalfire, a cyber-risk management firm.

Often the online banking features of a payment app will sit on top of the ACH bank payment network. This is the equivalent of a cash payment without the risk of having actual cash stolen from you in person, he explained.

“However, there are some drawbacks, especially when compared with using a credit card,” he told the E-Commerce Times.

For one, credit card payments are all underwritten by different laws depending on the jurisdiction in which you reside. These can provide significant consumer protection in the event of a dispute.

“As more people make remote payments using ACH, SWIFT, or wire transfers, many of the underlying bank-to-bank payment transactions are playing catch-up with the card networks since there are more concerns that criminals are trying to intercept and change payment destinations in order to get the bank payment routed to them,” Barratt warned.

Dedicated payment services tend to focus on niche areas, such as servicing the cash-only part of society or that provide switching services. These organizations look to see if they can get you better deals on the various bills you have.

“They often make payments using the underlying payment card or bank transfer, so the value to them is more consumer-focused,” said Barratt.

Consumers Options

Consumers have several options when paying their bills. The ACI Speepday Pulse survey indicates that the biller direct channel — where consumers pay directly on the biller’s website — is seeing higher adoption rates, with 59 percent against online banking bill pay from the consumer’s online banking account (used by 36 percent of respondents), ACI Digital’s Gupta explained.

In both scenarios, consumers can usually set up recurring payments to automate the process of paying the monthly bill. This “set it and forget it” approach continues to gain favor as the percentage of consumers paying at least some of their bills through automated recurring payments has increased from 56 percent in 2019 to 62 percent in 2020, he said.

“In addition, consumers are warming up to using mobile wallets to pay bills. The study showed that usage doubled year over year,” he added.

Consumers are starting to show a preference for receiving e-bills as opposed to paper bills delivered by postal mail — and actually paying their bills online, noted Gupta.

“Digital statements are becoming more preferred. However, a lot of consumers prefer to receive digital AND paper statements,” he said.

Although convenient for the consumer, billers have increased costs by sending physical statements. Digital billing notifications continue to increase as mail channels decline.

How Do Consumers and Billers Gain?

In the survey, consumers cite (in rank order) convenience, speed, simplicity, and making a smaller environmental footprint as the top five benefits of digital bill pay. Billers benefit from cost savings, customer satisfaction, improved consumer engagement opportunities, and better marketing opportunities with their customers., according to Gupta.

Payment card industry (PCI) compliance mandates are driving the way billers need to protect customer payment data. Consumers can feel more confident in biller systems, and billers can manage PCI scope with the right vendor billing solutions, which include security protocols, he observed.

Still, consumers can experience difficulty with digital payments due to the number of bills they pay per month. Many consumers are using recurring payment options as a way to manage their billing and payment activities.

Consumers should take advantage of all digital communication channels offered by their billers. These can include reminder notifications via text or email, or even making payments via a mobile wallet, suggested Gupta.

Digital Transformation

A crossover of sorts is taking place as consumers shift to e-bills and paying their bills online. This transformation has been ongoing for a number of years, often driven by utility companies that have established cadences for repeat billing or direct payment already seeking to reduce their overhead, according to Coalfire’s Barratt.

“Sending out hundreds of thousands of paper statements is quite expensive! For the consumer, an e-bill is usually cheaper and easier than a traditional paper bill,” he noted. “However, because of some demographic groups’ challenges with technology, e-billing and paper billing often need to run parallel with each other.”

Social Media

See all Social Media